Commercial

Farm | Contractors | Construction & More

No matter the size of your business, navigating the right choice for commercial insurance can be difficult. We can help you understand your options and provide you with a stress-free quote.

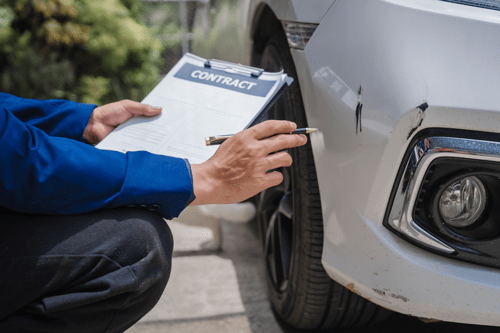

Personal

Home | Auto | Recreation

Choose insurance brokers that lets you live a worry free life. We can help you find personalized coverage that is tailored to your individual needs, providing you with simple solutions while making sure you understand the insurance you have purchased.

Life & Health

Life | Health | Travel

Contact us at James Campbell Insurance Brokers to learn about the various life insurance policies that are available, how affordable they are, and rest assured knowing that your family, your loved ones will be taken care of into the future.

Who we are

James Campbell Insurance Brokers was established in 1978 as an independent insurance provider. We are a family-owned business operating out of two locations in Uxbridge and Mount Albert, Ontario. We have been proudly serving our communities for over 40 years. We are incredibly proud of our roots. Our vision is always looking forward “to become our region’s most trusted and valued source for insurance solutions”. As a full-service insurance brokerage in Ontario, we strive to deliver tailored insurance offerings with unified, seamless and best-in-class customer service experiences.

Why Work With us

Tailored Solutions

With your life constantly on the move, your insurance needs to keep up. Our expert Insurance Brokers are here to make sure that it does.

Choice

With some of the top insurers in Canada, you can choose an insurance company with coverage and rates that suit you.

Service

Our clients are assigned to a dedicated insurance broker where we can develop relationships that truly matter.

"I recently switched my car insurance to James Campbell Insurance and I couldn’t be happier! Kyle was extremely helpful and made the transition so simple and stress free. Kyle and all of the other staff are knowledgeable, professional and friendly. I would highly recommend James Campbell!"

"I recently switched my car insurance to James Campbell Insurance and I couldn’t be happier! Kyle was extremely helpful and made the transition so simple and stress free. Kyle and all of the other staff are knowledgeable, professional and friendly. I would highly recommend James Campbell!"

Caitlyn M

"I have been a customer of James Campbell Insurance for about 9 years now, and I have had nothing but a great experience with them. Whenever I have had any questions, they are quick to respond. The staff is very friendly and efficient. I would highly recommend them!"

"I have been a customer of James Campbell Insurance for about 9 years now, and I have had nothing but a great experience with them. Whenever I have had any questions, they are quick to respond. The staff is very friendly and efficient. I would highly recommend them!"

Katie Graham

"I’ve been dealing with James Campbell for over 11 years. Started with apartment insurance and now they take care of my house and cars. They make sure I’m covered for all situations and that I have enough insurance. Very knowledgeable and easy to deal with."

"I’ve been dealing with James Campbell for over 11 years. Started with apartment insurance and now they take care of my house and cars. They make sure I’m covered for all situations and that I have enough insurance. Very knowledgeable and easy to deal with."

Trevor Mousseau

Previous slide

Next slide

Who we are

Incorporated in 1978 James Campbell Insurance Brokers is an independent insurance provider. A family owned business operating out of two locations in Uxbridge and Mount Albert Ontario. We have been proudly serving our communities for over 40 years! Although we are proud of our roots, our vision is forward looking “To become our regions most trusted and valued source for insurance solutions. A full service brokerage delivering tailored insurance offerings with a unified, seamless and best in class customer experience.”

Our Trusted Insurers

What Our Customers Have to Say

"I recently switched my car insurance to James Campbell Insurance and I couldn’t be happier! Kyle was extremely helpful and made the transition so simple and stress free. Kyle and all of the other staff are knowledgeable, professional and friendly. I would highly recommend James Campbell!"

— Mary Scott

"I have been a customer of James Campbell Insurance for about 9 years now, and I have had nothing but a great experience with them. Whenever I have had any questions, they are quick to respond. The staff is very friendly and efficient. I would highly recommend them!"

— Katie Graham

"I’ve been dealing with James Campbell for over 11 years. Started with apartment insurance and now they take care of my house and cars. They make sure I’m covered for all situations and that I have enough insurance. Very knowledgeable and easy to deal with."

— Trevor Mousseau

Our Latest Blogs

Posted By James Campbell Authors on 15-04-2025

How do you recover when a burst pipe floods your home or a windstorm rips off part of... READ MORE

Posted By James Campbell Authors on 20-03-2025

March Break is the perfect time for Ontario families, students, and vacationers to... READ MORE

Posted By James Campbell Authors on 18-02-2025

Canada’s public healthcare system offers great services, but it doesn’t cover... READ MORE

FAQs

James Campbell Insurance offers a wide variety of personal and commercial insurance options for our clients. We offer vehicle, home and business insurance and more through a large network of insurance providers in Canada.

If you are interested in lowering your insurance premium, speak with your insurance broker about the following:

- Increasing your deductible (your share of the cost of a claim). By increasing the amount of the deductible you are willing to pay, you will decrease your premium;

- Dropping your collision coverage on an older car;

- Bundling your car and home insurance with other types of insurance with the same insurance provider;

- Buying a car with a lower-cost insurance rating.

Our experienced insurance brokers can help you assess your needs based on the details you provide about your home, business or vehicle. In the case of home insurance, taking a complete inventory of your belongings will help you understand how much coverage you need and this will also make it easier for you to file a claim. Along with your contents, your dwelling limit is required to be insured to value. Therefore it is important to let us know about renovations and updates that you make to your home.

A deductible is the dollar amount you are responsible for paying when making a claim. For example, if your auto insurance policy has a $1,000 deductible for vehicle collision and there are $5,000 in damages, you will pay the first $1,000 then your insurance company will pay the remaining amount of $4,000.

Replacement costs are the total cost that your insurance company will pay to fully reconstruct your home if it were destroyed. The replacement cost will include things that may not be included in the resale value, like the cost and availability of skilled labour, debris removal, other expenses related to building codes, and more. If you have made upgrades or renovations to your home, be sure to speak with your broker to make sure you still have the right coverage.

For an Auto Insurance quote, your driver’s license number, insurance history and driving records are important factors in getting an accurate quote. For a Home Insurance quote, details on the home, such as year built, square footage, style of home and updates on the roof, electrical, heating, and plumbing are all important factors in determining the premium. Additional factors, such as acreage, swimming pools and ponds all play a role in determining the coverage you will need along with the premium.

Send us a Message

Uxbridge Office

33 Toronto Street N., Unit 1 Uxbridge, ON L9P 1E6

Mount Albert Office

19139 Centre Street, Unit 1 Mount Albert, ON L0G 1M0